Though residential real estate market has been a bit bogged down by the dip in demand and high inventory levels, commercial real estate on the other hand has witnessed green shoots of late. According to a report by KPMG- Real Estate Opening doors, it is estimated that the size of Indian real estate sector may increase by as much as 5 fold i.e. to $ 676 billion by the FY 2025. Our country has an urban population that is equivalent to the sum of population of USA and UK. With more than 10 million people moving to cities annually a strong growth potential lies ahead on road for us. Here is a small report as to how India’s journey has been and would be in the coming years.

| Unit | 2014-15 | 2015-16 | 2016-17 F | ||

| Macroeconomic outlook | |||||

| GDP | % (Growth) | 7.3* | 7.6 | 7.9 | |

| CPI Inflation | % (Average) | 6.0 | 4.9 | 5.0 | |

| 10-year G-Sec | % (March-end) | 7.7 | 7.5 | 7.3 | |

| Exchange rate | Re / US$ (March-end) | 62.6 | 66.3 | 66.5 | |

Source:CrisilResearch

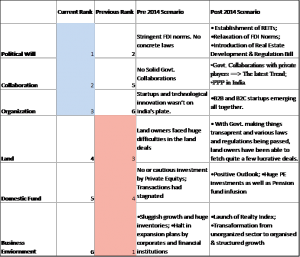

What we have done is we here have analyzed 6 factors that have been changing the scenario in the real estate sector since 2014. So a comparison of these six, post and pre 2014 would definitely help to capture how the tide has been changing in the commercial real estate sector.

# Political Will

The Indian government in the past few years has taken noteworthy steps for various landmark reforms to attract foreign investment. India has been one of the few economies with a positive and favorable economic outlook in the past few years. Efforts by the government to improve the economy has prompted global investors to invest in India. A new land acquisition has replaced the veteran legislation. Accordingly, Real Estate Development and Regulation Bill has streamlined an approval system and a real estate regulator is expected to be appointed in each state. Increasing levels of Income of the people and the opening up of the sector to foreign direct investment has really changed the real estate sector outlook and it has witnessed phenomenal growth. The government in the last fiscal removed all restrictions on FDI in real estate. There is no lock in period for FDI investments into hotels, resorts, SEZs, NRI investments. This will definitely improve the liquidity scenario and will also speed up the investment process which earlier used to take a lot of time due to the structuring of the vehicle (SPV) to be compliant with FDI vehicle projects.

Source: – KPMG- Challenging the Tides

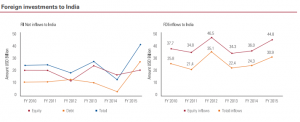

FDI and FII inflows post 2014 touched record high numbers with FIIs investing USD46 Billion in FY15 which was 5.3 times the investment in FY14 and FDI investments increased by 24% in FY15 in comparison to FY14.

# Collaborations

Among the latest trend, government has shortlisted smart cities that it plans to build in collaboration with an international organization- Bloomberg Philanthropes. Shortlisted cities will receive INR 1 Billion grant for five years. Leading developers in India are already collaborating with global luxury brands and hotel chains thus scouting for new ideas to attract HNIs. Such collaborations between government and private sector players will definitely impact the success, outcome and progress of the real estate sector. Though according to Modiji smart cities would have technology based solutions, the first 33 smart cities that have proposed reveal that 73% of the projects are expected to be construction intensive and a significant amount of construction spends are expected in future. Smart cities are expected to offer large scope for real estate price appreciation over a long time.

# Organization

With startups growing prominently in India, Real estate sector is not far left behind where a lot of B2B and B2C startups have started working alongside the real-estate sector. Various B2B startups have set up online user friendly platforms that provide online access to buyers and sellers of commercial real estate nationwide. Thus agents/ brokers using the online platforms to run their businesses more effectively and efficiently is a wave of innovation. Improved data management in the real estate sector where information on how transactions happened between the buyers and sellers and brokerages with the best data making the most money will definitely democratize commercial real estate nationwide. Also there are provisions for initial challenges for startups such as outlay of heavy capital investment and a long gestation period however in the long run it presents an improved quality of life and an integrated environment for everyone.

# Land

Owing to better macro-economic outlook and corporate expansion since 2014, the Indian IT, Information Technology Enabled Services, the BFSI sector have strengthened in the last couple of years. Where the IT sector is poised to further grow and strengthen, the Indian commercial real estate sector has drawn along this growth. The commercial office market has proliferated with a surge in the absorption levels across all the major metro cities and non-metro cities. According to a report by KPMG the total commercial office space absorbed between H1 2014 to H1 2015 was 58081 Mn sq. ft. with Bangalore witnessing the maximum absorption followed by Mumbai, Gurgaon and Pune. Previously i.e. before FY 2013/14 the economy slowdown and low demand had led to disappointment among the real estate players. Even the landowners were a bit resilient as they could not fetch lucrative prices which had eventually happened because the customers had lost confidence in the completion of the projects and were not willing to buy.

# Domestic Fund

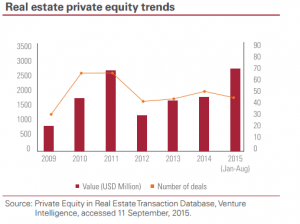

Till the global economic downturn and post that for few years, India’s major sources of funding in the Real Estate sector were QIP, NBFCs, Bank lending and private lending. Private Equity had a very small percentage in the entire pool. But post 2013, driven by high returns on investments, the sector observed huge capital deployment from the PE funds. Also corporate developers went a way ahead and looked for funds through the capital markets which eventually reduced the overall dependence on banks. The NBFCs and PEs have been gaining importance ever since the banks reduced the pool of credit to commercial real estate in the last half a decade. According to a report by KPMG, the credit given by banks to commercial and residential real estate has declined from 10% to 8% in the past half a decade.

Source:-KPMG, challenging the tides

Given the signs of improvement and yield curves stabilizing post the new “ache din” government an upward trend can be observed in terms of value and investment by funds in the number of deals driven by domestic fund managers. Also a large bunch of sovereign and pension funds, which are generally long term, infused funds into the real estate sector. By large, increasing occupancy levels along with stable rentals and significant scope of capital appreciation has validated the increased investments by the domestic fund managers.

# Business Environment

From being a mostly an unorganized sector in the past, the real estate sector has transformed to a more structured and organized sector. This could be attributed to investments by a lot of Private Equity and strategic investments that took place and a lot startups that have taken the initiative and streamlined as well as made the real estate business look efficient. Channels such as Private Equity in the real estate sector have gained significance since the time cash flows from other source of investments had moderated during the period 2009-2013 due to low and slow growth, currency depreciation and inflation. Other sources of investments here mean capital markets, banks or private lenders. Until 2014, the demand in the real estate sector was very sluggish which had led to high inventories. There were hardly or cautious PE funding (if any) as the focus was mostly on structured debt deals. But post 2014, introduction of schemes such as housing for all, REITs, Smart Cities initiative, Real Estate regulation and development bill led to the revival of the sector. Also increased investments by the PE investors and selective penetration by sovereign & pension funds did improve the confidence in the prospects of the sector.

Well written. You have thoroughly elaborated the shift in Indian real estate industry.