Impact of demonetisation on different segments of the real estate market

Different segments of the real estate market, like primary, resale, land, will be impacted differently by the recent demonetisation. Rxprt analyses how each segment is likely to fare in the short to long term

Many people who have recently sold their properties and accepted partial payment in cash, have no option but to declare the amount and pay taxes on it. Demonetisation has resulted in a slowdown in sales, as buyers and sellers wait for cash availability to normalize.

The primary market (purchase of properties directly from developers) will not be affected much because it is already at the bottom of the price trends and further corrections are not possible. Moreover, the primary market is mortgage driven, especially at the lower and mid-end and will not face many problems. However, the luxury segment could see a bit of correction.

Land sales and the secondary (resale) market are likely to be hit for some time though due to the liquidity crunch, as investors wait for better returns.

Will demonetisation result in all white property deals?

Property consultants maintain that in the primary market, nearly all the reputed builders in metros, have stopped taking cash. With transactions occurring through accounted payments, such as cheques, demand drafts or bank transfers, experts opine that the primary markets will not be affected.

Nearly 90% of the primary market in the metros, will not be impacted. The tier-2 and tier-3 cities will surely be affected though as the cash component is relatively higher in these cities.

Demonetisation may also cause a slight spike in distress sales. Earlier, consumers with ready payment abilities, were able to bargain and get a good deal. Now, this may be more unlikely.

Demonetisation’s impact on artificial inflation

A common belief is that the real estate market is artificially inflated, due to the circulation of black money. However, developers maintain that this is not true for primary markets, as investors are no longer present in this market. “The primary reason for this, is that the return on investment in properties for investors, is not sufficient. The purchasers are actual end-users. Thus, there should not be a significant effect on the prices.

Inflated property prices are a result of the presence of black money. As a result, the prices of resale flats will come down by 20%-40%. With demonetisation, such artificial demand will go down in the medium term, which is a major positive for realty.

If a seller is unable to accept a ‘black’ component for the sale consideration, he may simply ask for the entire consideration in ‘white’ and levy on the purchaser, all the taxes that will be additionally incident in the process, resulting in increased prices. The same thing could happen in the primary market, if upstream transactions have unaccounted components.

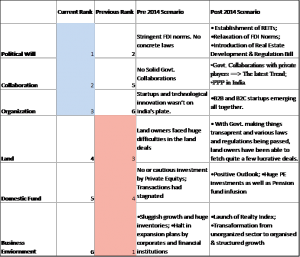

In this scenario, recent laws on real estate, like RERA, GST, and Real Estate Investment Trusts (REITs), can bring in the much-needed transparency and increase buyers’ confidence in the real estate market.

Which property markets will be affected by demonetisation?

- Nearly 90% of the primary market in the metros will not be impacted by demonetisation.

- Tier-2 and tier-3 cities are likely to be affected, as the cash component is relatively higher in these cities.

- Land sales and the secondary (resale) market are likely to be affected for some time, due to the liquidity crunch.